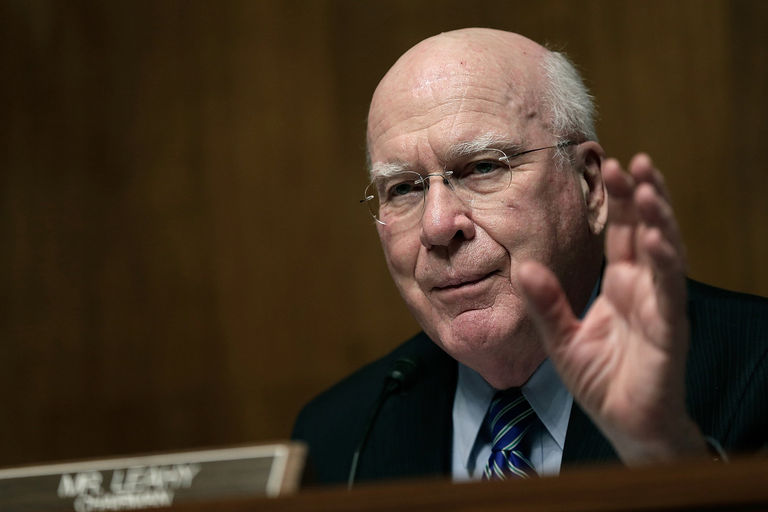

Here is my floor statement on Republican budget reconciliation bill:

Mr. President, I strongly oppose the Republican budget and the package of reconciliation bills we will be debating over the next two weeks.

This Republican budget and these reconciliation bills are fiscally irresponsible and will increase the deficit.

The budget and these reconciliation bills are based on the wrong values, harming vulnerable Americans to provide tax breaks for special interests and multi-millionaires.

And with so many other serious problems facing middle class families and our nation, the decision to focus on this reconciliation legislation reflects seriously misplaced priorities.

Together, we can do better.

Mr. President, the budget of the United States ought to be a mirror of our nation’s values. A budget reflects what we think is important—what we care about, and what we don’t. It says a lot about who we are and what we value, as a people and a nation.

In essence, Mr. President, a budget is a moral document. Unfortunately, the Republican budget is an immoral document.

That’s not my term, M. President. That’s the conclusion of some of our nation’s leading religious leaders who, citing Scripture and the Bible, have urged all of us to oppose this budget reconciliation process. As Bishop Mark Hansen, the Presiding Bishop of the Evangelical Lutheran Church in America put it, “This is not the time to cut…important programs while using the cuts to pay for tax breaks for those who don’t need them.”

Mr. President, my Republican friends will portray their budget as a way to reduce the deficit. In truth, their budget, and these reconciliation bills, actually would make the deficit worse. In fact, debt under their budget would go up by about $3 trillion in just five years. That’s fiscally irresponsible at any time, but especially when we should be saving to prepare for the baby boomers’ retirement.

Mr. President, let’s review some history. When this Administration came to power, our nation had finally put our fiscal house in order. After many years of deficits and raids on Social Security to pay for other programs, Democrats—without the help of a single Republican vote—stopped that practice. As a result of our efforts, this nation ran a surplus from 1998 through 2001, and it was projected we would enjoy surpluses for as far as the eye could see. At the time, our future looked so bright that many economists, including Alan Greenspan, were seriously worried about what would happen to financial markets if we eliminated our debt altogether.

Unfortunately, in five short years, with Washington Republicans firmly in control of the White House and both houses of Congress, we have moved from a period of record surpluses to a time of record deficits. Once again, we are raiding Social Security. And the deficits in each of the last three years have been higher than at any time before President Bush took office.

Mr. President, the latest Republican budget before us will make matters worse. While the majority has divided its budget in a way that obscures its overall effect, nobody should be fooled. Viewed as a whole, budget reconciliation would increase the deficit by more than $30 billion. And after five years, under their budget, our national debt would exceed $11 trillion.

But, Mr. President, the problems with their budget go well beyond its fiscal irresponsibility. This budget reflects the wrong values. It puts more burdens on those already struggling. And if that isn’t bad enough, it takes the sacrifices it demands of the less fortunate to partially pay for another round of large tax breaks for special interests and multi-millionaires.

Let’s look at what’s in the bill before us.

The budget increases burdens on America’s seniors, by increasing Medicare premiums.

It cuts health care – both Medicare and Medicaid – by a total of $27 billion.

It cuts support for farmers by $3 billion.

It cuts housing.

It allows drilling in an Alaskan wildlife refuge, at the behest of the oil and gas industry.

And if you take a look at what’s happening in the House of Representatives, you can see what’s likely to be coming down the pike.

Student loan cuts.

Food stamp cuts.

Cuts in child support enforcement.

Deeper and more painful cuts in health care.

And why? Why are we using expedited procedures for cuts that will harm millions of seniors and working Americans?

Is it to reduce the deficit? No.

Is it to pay for Katrina? No.

Is it to prepare for the Avian Flu? No.

It’s to provide congressional Republicans fiscal cover today so they can turn around tomorrow to provide tax breaks to special interests and multi-millionaires.

Let me be more specific. The capital gains and dividend tax breaks in the Republican budget would provide 53 percent of its benefits to those with incomes greater than $1 million. Those lucky few will get an average tax break of about $35,000.

But what about those with incomes between, say, $50- and $200,000? Well, they’ll get an average tax cut of $112.

And what about those with incomes less than $50,000?

$35,000 for those with incomes more than a million dollars. $6 dollars for those earning less than $50,000.

And to partially pay for these tax breaks, many Republicans now want to cut Medicare. Cut Medicaid. Cut agriculture. Cut housing. Cut student loans. Cut child support enforcement. Cut services that Katrina survivors rely on. Cut benefits needed by our nation’s most vulnerable Americans.

Mr. President, now you know why some of our nation’s most respected religious leaders call this budget immoral. These choices do not reflect the best of America’s values. This is not what most Americans would want.

We can do better.

Finally, Mr. President, beyond the fiscal irresponsibility of this budget and the disturbing choices it makes, there are other more important priorities that the Senate should be addressing.

Gas prices are skyrocketing. Families are struggling to fuel their vehicles and heat their homes. Farmers and businesses are feeling the pinch. Democrats have a plan to respond, to address price gouging and, ultimately, to make our nation energy independent. That’s more important than harming the vulnerable to provide tax breaks to special interests and multi-millionaires, while increasing the deficit.

Hurricane survivors are struggling. Thousands lack health coverage. More than 200,000 still live in hotel rooms. Devastated communities have been forced into massive layoffs and are unable to provide even basic services. And many survivors, having lost everything, are facing the threats of foreclosure and bankruptcy. Democrats have a plan to address these urgent needs. That’s more important than harming the vulnerable to provide tax breaks to special interests and multi-millionaires, while increasing the deficit.

The Iraq war is not going as well as the Administration promised. 2000 Americans have died. Over 15,000 have been badly injured. 150,000 more remain in harm’s way, while the Administration still has no plan to end the conflict and bring them home. Instead of being greeted as liberators, the violence continues nearly 2 ∏ years after the start of the conflict. Our nation badly needs a strategy for success. And that, too, is more important than harming the vulnerable to provide tax breaks to special interests and multi-millionaires, while increasing the deficit.

So, Mr. President, I urge my colleagues to defeat the Republican budget. It’s fiscally irresponsible. It’s based on the wrong values. And it reflects the wrong priorities.

Together, we can do better. Let’s reject this budget, and then let’s focus on the real needs of the middle class and our nation.